This op-ed was first published on 19 December on Crikey here > https://www.crikey.com.au/2016/12/19/rudd-gillard-and-abbott-cut-taxes-a…

The debate surrounding MYEFO and whether Australia has a credible path back to a surplus should start by remembering how we got here.

If Scott Morrison had delivered much of Peter Costello’s taxation ratio the budget would not be in deficit today.

This Government has set a target ceiling for the country’s tax to GDP ratio of 23.9%. If Australia had that rate over the last decade, net government debt today would be zero and for the last year alone there would have been an additional $30B in revenue for the Treasurer.

These are the facts uncovered in an Australia Institute report — Taxing times: The impact of the GFC on tax revenue in Australia — from senior economist Matt Grudnoff out today. Of course, it would not necessarily be sensible economic policy for Australian government debt to be zero in 2016. However the absurdity of suggesting the budget can only be ‘fixed’ via cuts to spending is laid bare by the startling fact that the current $329B net government debt would be wiped out if tax-to-GDP ratios delivered by Costello (and promised for the future by the current Treasurer ) had been in place for the last 8 years.

The Australia Institute’s modelling shows that if tax revenue had not remained so low post-GFC then there would have been only two years where the budget was in deficit during the term of the previous Labor government. These deficits in the model are of course caused mainly by Wayne Swan’s stimulus spending which staved off a recession. Remarkably if the 2016 financial year had delivered a tax to GDP ratio nearer to the last years of John Howard, there would have been an extra $30B in cash for Treasury, a similar amount in 2015, and closer to $40B in extra revenue in 2014.

The model also shows that the accumulated deficit, which is roughly equal to government debt, would have been effectively non-existent today had the tax to GDP ratio simply held at Costello-Howard levels. So the main factor leading to the post GFC deficits and the accumulation of government debt has been the remaining low tax revenue. The size of the accumulated deficit also gives an indication of what the low tax revenue has done to the size of the debt with the accumulated deficit in effect being the sum of all the deficits after the GFC.

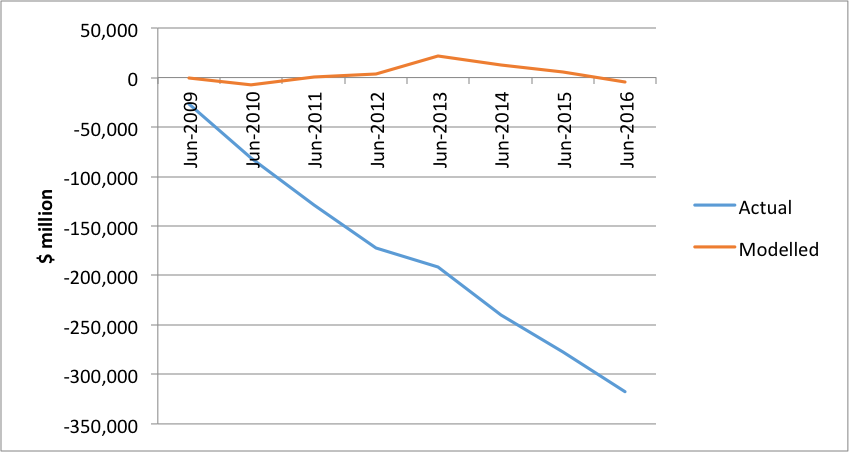

The graph below from today’s report shows the actual accumulated deficit (blue line) and the modelled accumulated deficit (red line). The actual accumulated deficit grows over the whole time period, but under the modelled scenario we see an initial deficit but this quickly vanishes with the final outcome almost in balance by 2015-16. This highlights that the current debt is mainly driven by the post GFC low tax revenue. Put simply because Australia did not have any net debt at the time of the GFC, if the tax to GDP ratio had stayed at 23.9% through to now, Australia debt would still be at zero.

Actual and modelled accumulative deficit 2009-2016

Effectively the blue line is the accumulated deficit accruing post GFC (2008-09) while the red line is what the accumulated deficit would have been had the tax to GDP ratio remained constant.

Today wage growth is weak; the worst global economic downturn in 70 years is still fresh; Australia has just had an unexpected negative growth quarter, so it is no time to be running fierce contractionary, austerity style policies that either cuts spending or raises taxes too sharply in an attempt to wind back GFC inspired deficits too quickly.

However the recent history and projections for the overall taxation take are revealing. Australia sits as one of the lowest taxing countries in the OECD. Our population is expanding rapidly and our city infrastructure is failing to keep pace with that growth. The history of Australia and indeed every developed country is that of an expanding tax base to build a richer more prosperous nation. It is no accident that poorer developing nations have lower tax to GDP ratios. Such countries have worse infrastructure, worse services and poorer amenity. An educated workforce; healthcare for everyone; parks; energy networks; water on tap; a transport system fairly accessible to most, have all been built with an expanded tax base. It’s the price of civilisation.

Australia can increase its tax to GDP ratio modestly with no harm to our economy. In fact the opposite will be the case. Building and funding the hard and soft infrastructure that the public craves will drive continuing prosperity. Alternatively we can bet against what the history of economic development has taught us and chase some arbitrarily low tax to GDP ratio.

And if you were the Government with the budget well below even its tax to GDP ratio target of 23.9%, it makes no sense to pursue a $50B company tax cut that is as fiscally reckless as it is politically toxic.

Between the Lines Newsletter

The biggest stories and the best analysis from the team at the Australia Institute, delivered to your inbox every fortnight.

You might also like

Stage 3 Better – Revenue Summit 2023

Presented to the Australia Institute’s Revenue Summit 2023, Greg Jericho’s address, “Stage 3 Better” outlines an exciting opportunity for the government to gain electoral ground and deliver better, fairer tax cuts for more Australians.

Tasmania’s fear of government debt is hurting the state

Tasmanians have been badly served by its government’s exaggerated fears about the condition of the state budget.

HECS/HELP debt for low income earners is set to increase due to indexation

The indexation of HECS/HELP debt this year will leave people earning less than $62,000 with a bigger debt even after their repayments.