Time for Facts on Franking Credits

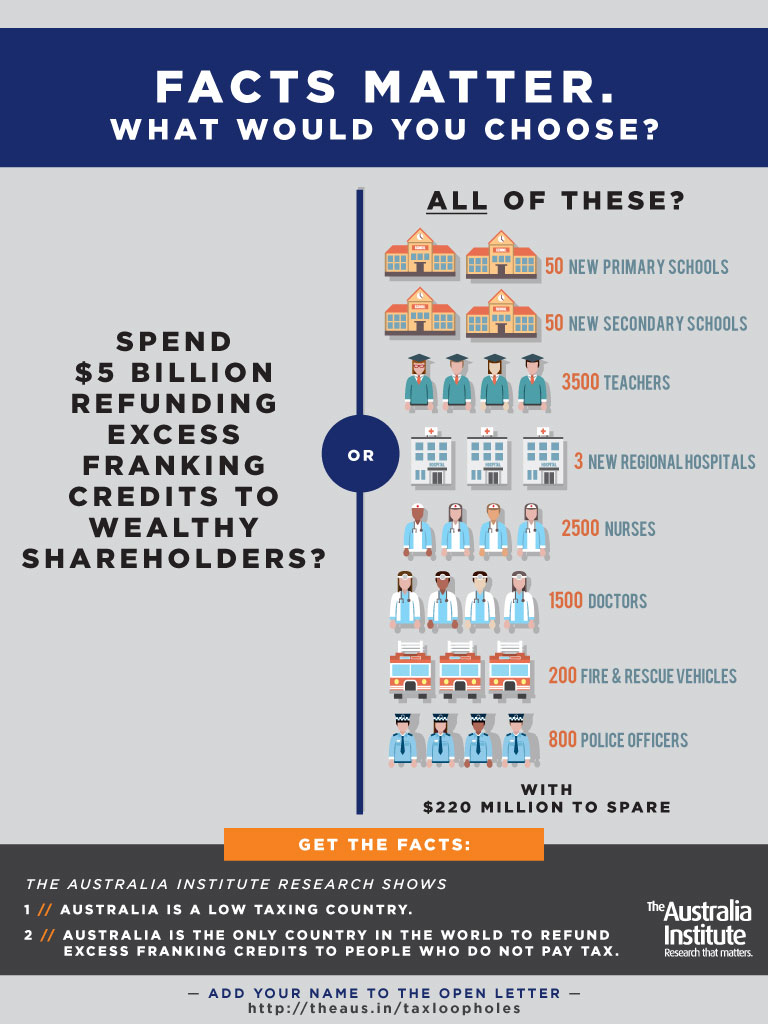

A full page advertisement published today by The Australia Institute promotes new research showing the forgone revenue spent refunding excess franking credits to wealthy shareholders could be used to create jobs and fund services to the community instead.

The foregone revenue on cashing out excess franking credits could purchase:

- 50 new primary schools, 50 new secondary schools and 3500 teachers,

- 3 new regional hospitals, 2500 nurses and 1500 doctors,

- 200 fire & rescue vehicles and 800 police officers,

- with an extra $220 million to spend funding other essential services.

“How much revenue Australia spends giving tax bonuses to wealthy shareholders ought to come under more scrutiny,” said Ben Oquist, Executive Director of The Australia Institute.

“Our research shows Australia is the only country in the world to give such tax bonuses to people who do not pay tax and it is the community who is paying the price in foregone funds for services and infrastructure investment.

“Australia is a low taxing country, we need to talk more about raising revenue.

“After decades of spending cuts, efficiency dividends, and budget emergencies it is time to confront the fact that many of Australia’s problems, both real and imagined, flow directly from the fact that we have chosen to be one of the lowest taxing countries in the developed world.”

The full page advertisement was published in The Saturday Paper on 23 February 2019

Related documents

General Enquiries

Emily Bird Office Manager

Media Enquiries

David Barnott-Clement Media Advisor